Practical materials on alternative investing, real estate fundamentals, and the tax & liquidity lens we use when evaluating opportunities.

Materials designed to educate, be practical and investor-friendly.

A practical overview of value-add multifamily and development partnerships, how depreciation and cost segregation typically work, and the diligence questions to ask before investing.

* Educational only - not tax, legal, or investment advice.

If you want an occasional note when something substantive is published, join the investor list.

Third-party articles that discuss the importance of real estate as a key component of a balanced, return-focused investment portfolio.

A helpful perspective on why income-producing real estate has remained durable across cycles.

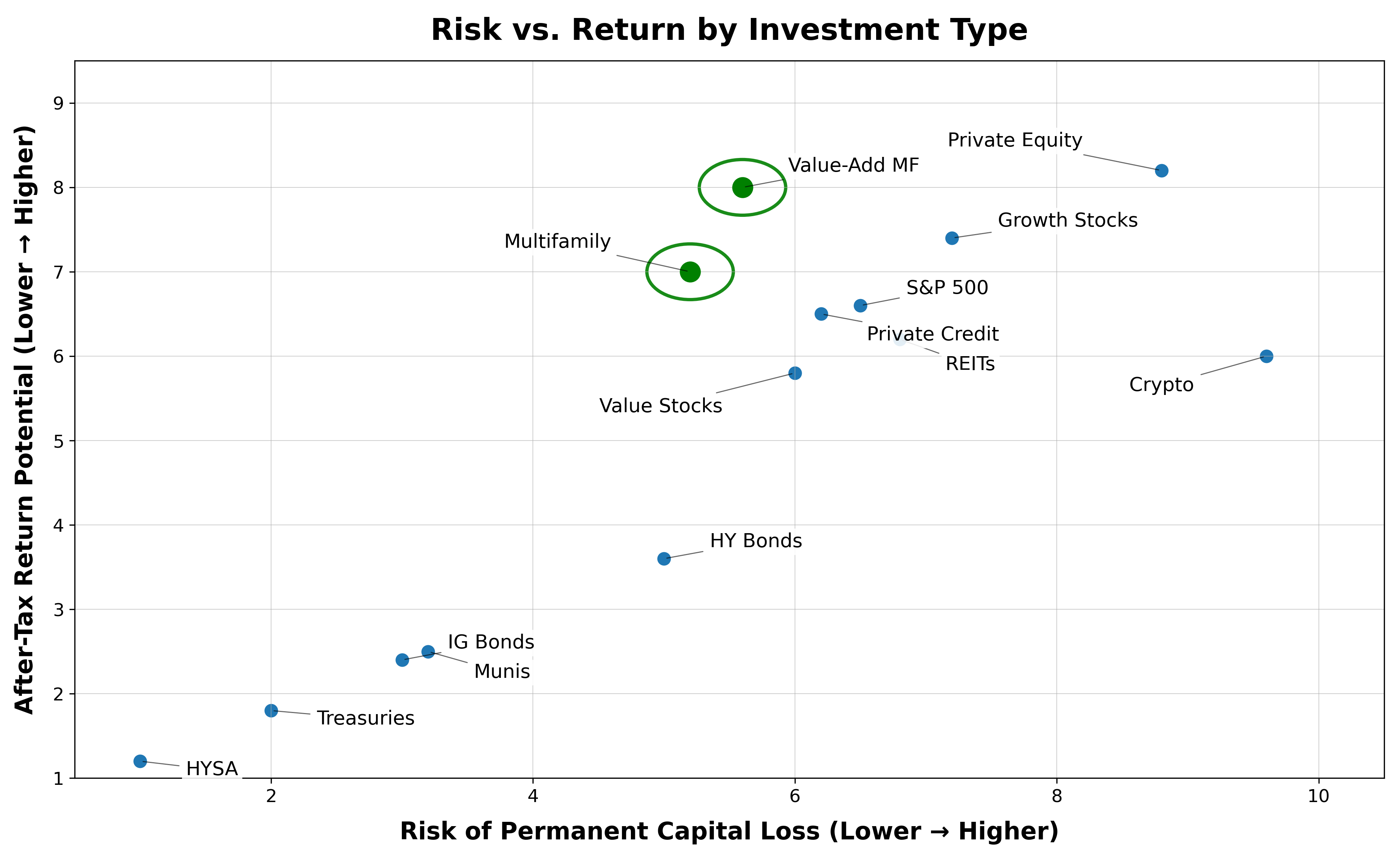

A clear, investor-focused explanation of where real estate fits within a diversified portfolio, including risk, return, and allocation considerations.

A few credible sources to support your learning journey. If you have an article you’d like to share, send it my way.

A few posts with commentary and real-world examples from active ownership and execution.

A quick takeaway and why I thought this Kiplinger piece was worth sharing.

A look at a successful value-add renovation completed on Sea to Summit's midrise condo in Little Italy San Diego.

For periodic notes on markets, investing frameworks, and behind-the-scenes execution.

Note: Posts are informational and not investment advice.